Financing Policy

Basic Policy

Ichigo Green will maintain and implement a well-planned, flexible financial strategy for the purpose of generating a stable stream of profits and achieving the solid growth of the portfolio over time.

| Equity Strategy | When issuing additional shares, Ichigo Green will take into account such factors as the ratio of total debt to total assets ("the interest-bearing debt ratio") and the property acquisition plan while paying due attention to the potential share dilution (i.e., impact on dividends and net assets per share). |

|---|---|

| Debt Strategy | Debt Financing Policy

|

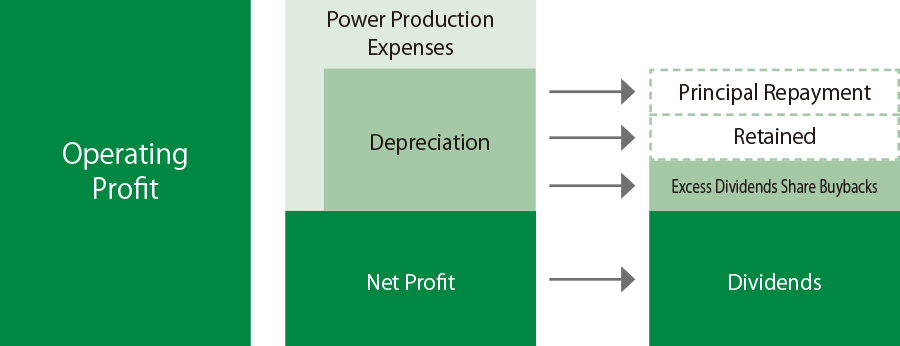

Excess Dividend Distribution and Share Buybacks

As a basic dividend policy, Ichigo Green will strive to distribute to its shareholders a dividend in excess of earnings in the amount equivalent to 40% of depreciation during each earnings reporting period.

In doing so, Ichigo Green will also strive to maintain sufficient financial flexibility to fund the capital expenditure and plant improvements required in our long-term maintenance plan, and also future plant acquisitions.

In accordance with Article 8-2 of our Articles of Incorporation, Ichigo Green may buy back our own shares that are traded on the Tokyo Stock Exchange. Share buybacks have the same economic effect as excess dividend distribution.