Dividends

FY25/6

(JPY)

| Dividend per Share (Excluding DEE) |

1,502 |

|---|---|

| DEE per Share | 2,383 |

| Dividend per Share | 3,885 |

Note : DEE=Dividend in Excess of Earnings. The DEE is paid from Ichigo Green’s solar power production revenue (which Ichigo Green receives in cash) that are not treated as income under Japanese tax rules, because they are offset by non-cash depreciation expenses.

- Fiscal Year: July 1, 2024 – June 30, 2025

- Dividend Payment Date: September 19, 2025

Japanese Tax Treatment of FY25/6 Dividend

Shareholders of record as of June 30, 2025 are eligible to receive the dividend.

Click here for DEE per Share.

FY26/6 (Forecast)

(JPY)

| Dividend per Share (Excluding DEE) |

1,715 |

|---|---|

| DEE per Share | 1,825 |

| Dividend per Share | 3,540 |

- Fiscal Year: July 1, 2025 – June 30, 2026

- Dividend Payment Date: Late September 2026

The forecasts presented above is based on certain preconditions as of February 16, 2026. The preconditions are subject to change due to such factors as future acquisitions and dispositions of renewable energy power plants, changes in the Tokyo Stock Exchange Infrastructure Fund market, fluctuations in interest rates, the issuance of additional shares, and changes in other factors related to Ichigo Green. The actual dividend per share (including DEE) may vary due to changes in circumstances. These forecasts should not be construed as a guarantee of such performance or results.

Shareholders of record as of June 30, 2026 are eligible to receive the dividend. The final trading day on the Tokyo Stock Exchange to be eligible for the dividend is June 26, 2026.

Click here for details of DEE per Share.

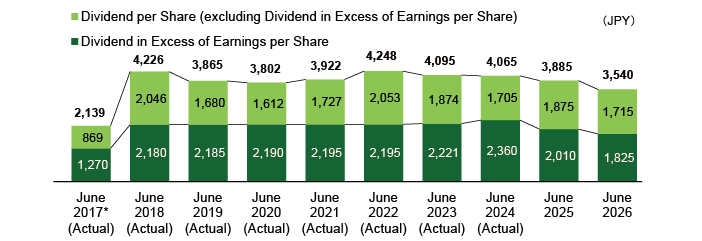

Historical Performance

(JPY)

-

FY16/9

(June 24, 2016 – September 30, 2016)- FY17/6

(October 1, 2016 – June 30, 2017)4,278 * FY18/6 (Ending June 30, 2018) 4,226 FY19/6 (Ending June 30, 2019) 3,865 FY20/6 (Ending June 30, 2020) 3,802 -

FY21/6 (Ending June 30, 2021) 3,922 FY22/6 (Ending June 30, 2022) 4,248 FY23/6 (Ending June 30, 2023) 4,095 FY24/6 (Ending June 30, 2024) 4,065 FY25/6 (Ending June 30, 2025) 3,885 FY26/6 (Ending June 30, 2026) 3,540 (forecast)

* Two-for-one stock split on January 1, 2018

- * Adjusted to reflect two-for-one stock split on January 1, 2018.

- * Ichigo Green's actual operating timeframe during FY17/6 was the 7-month period from December 1, 2016, the day it acquired its first power plants, to June 30, 2017.

Any questions concerning the receipt of dividend should be referred to:

If you have a securities account, please contact the securities company managing your account.

You can receive your dividend at the following financial institutions:

Head Office or any Branch of Mizuho Trust & Banking

Head Office or any Branch of Mizuho Bank, Ltd.

(Mizuho Securities will only be able to transfer your request.)

For questions concerning the receipt of your dividend, please contact the Shareholder Registrar.

Shareholder Registrar

Mizuho Trust & Banking Co., Ltd

1-3-3 Marunouchi, Chiyoda-ku, Tokyo

Mizuho Trust & Banking Co., Ltd. Securities Agency Division

2-8-4 Izumi, Suginami-ku, Tokyo, 168-8507

Available on weekdays from 9am to 5pm JST